This section of our website is not or not completly available in your preferred language.

Alternatively, you can visit the page in one of the languages available:

Open page in German

Open page in French

Open page in Italian

Voluntary affiliation of individuals

You have the option to conclude voluntary insurance with the Substitute Occupational Benefit Institution. Depending on your personal situation, please choose from the following pension plans, the one who suits best your individual situation.

Next steps

As a self-employed individual, you can take out insurance from the Substitute Occupational Benefit Institution under the SE plan. The contributions and benefits under the SE plan are based on the general regulations and the SE pension plan.

In order to join the SE plan, please send us the following documents:

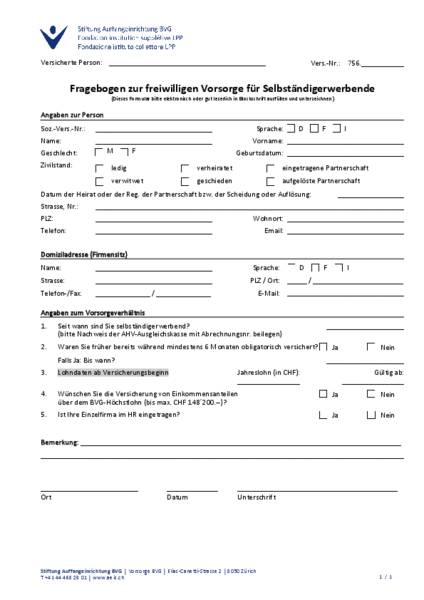

- Completed and signed questionnaire on voluntary insurance for self-employed individuals

- Completed and signed notification of joining

- Confirmation from the responsible AHV compensation fund of your accounting as a self-employed individual

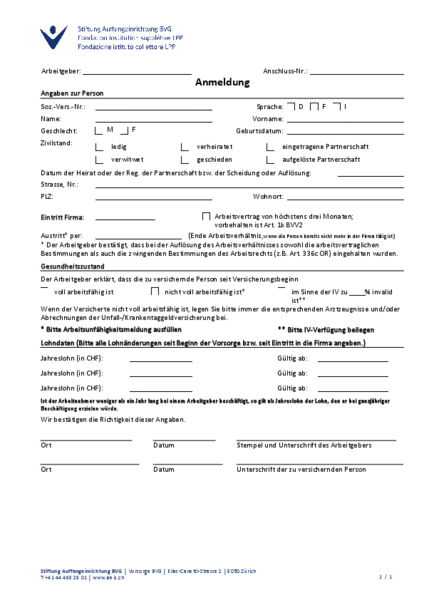

- Completed and signed registration for individuals

- Completed and signed health questionnaire

You can obtain voluntary insurance under the MA pension plan in the following cases:

- You work for multiple employers and your annual salary subject to AHV is greater than the BVG minimum salary according to art. 7 BVG

- You work part-time and are self-employed in your main occupation

The contributions and benefits under the MA plan are based on the general regulations and the MA pension plan.

In order to join the MA plan, please send us the following documents:

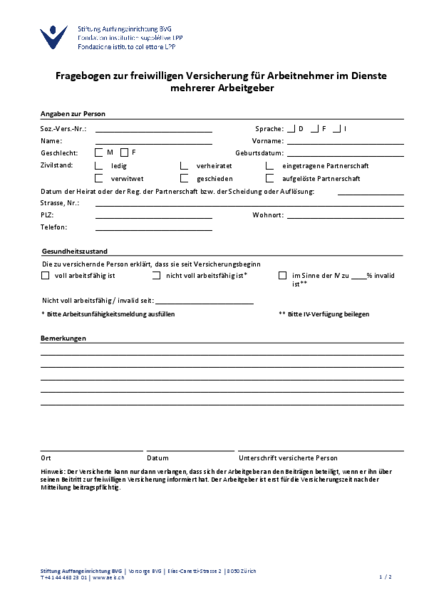

- Completed and signed questionnaire on voluntary insurance (including a summary of employment income).

- Completed and signed notification of joining

- Copy of your pension statement if you have a mandatory occupational pension from an employer

- A wage statement from your employer for each employment relationship

- Completed and signed registration for individuals

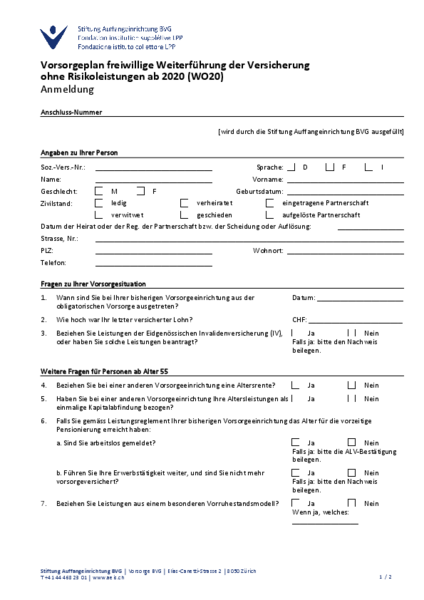

If you leave the mandatory insurance from your previous pension fund, you can continue to be insured voluntarily by the Substitute Occupational Benefit Institution. With the WO20 plan you only continue your savings insurance (no insurance of risk benefits).

In this case, you need to complete the registration for the WO20 Plan. The contributions and benefits are based on the general regulations and the WO20 pension plan.

The Substitute Occupational Benefit Institution must receive your completed and signed registration, along with the required documents, no later than three months after you leave your previous pension fund.

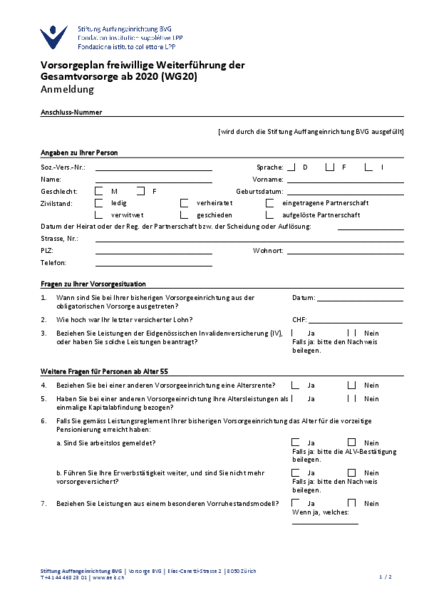

If you leave the mandatory insurance from your previous pension fund, you can continue to be insured voluntarily by the Substitute Occupational Benefit Institution. With the WG20 plan you can continue your entire insurance (savings insurance and insurance of risk benefits).

In this case, you need to complete the registration for the WG20 plan. The contributions and benefits are based on the general regulations and the WG20 pension plan.

The Substitute Occupational Benefit Institution must receive your completed and signed registration, along with the required documents, no later than three months after you leave your previous pension fund.

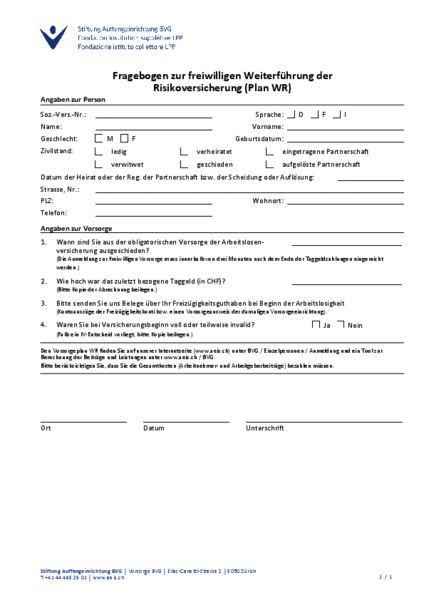

In the pension plan WR, you may conclude voluntary insurance against the risks of disability and death, if your claim for daily allowances from the unemployment insurance has expired (and therefore you are no longer covered by a mandatory occupational benefit plan for unemployed persons). The contributions and benefits under the WO plan are based on the general regulations and the WR pension plan.

In order to join the WR plan, please send us the following documents:

- Completed and signed registration documents for voluntary WR insurance

- Copy of your last daily allowance statement from the unemployment office

The Substitute Occupational Benefit Institution LOB must receive the application documents no later than three months after you leave mandatory occupational pension scheme.

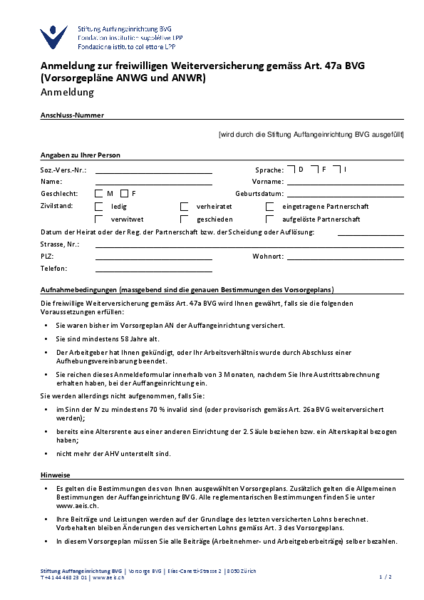

In accordance with Art. 47a BVG, you have the option of continuing the full pension scheme under its current conditions if you meet the following criteria:

- You were previously insured in the AN pension plan of the Substitute Occupational Benefit Institution.

- Your employment relationship was terminated by the employer or by concluding a termination agreement.

- Your employment relationship was dissolved on 31 July 2020 or later.

- You are at least 58 years of age when your employment relationship ends.

In this case, please complete the registration for the ANWG plan. The contributions and benefits are based on the general regulations and the ANWG pension plan.

The Substitute Occupational Benefit Institution must receive your completed and signed registration, along with the required documents, no later than three months after following the end of your employment relationship.

In accordance with Art. 47a BVG, you have the option of continuing your risk insurance under its current conditions if you meet the following criteria:

- You were previously insured in pension plan AN of the Substitute Occupational Benefit Institution.

- Your employment relationship was terminated by the employer or by concluding a termination agreement.

- Your employment relationship was dissolved on 31 July 2020 or later.

- You are at least 58 years of age when your employment relationship ends.

In this case, please complete the registration for the ANWR plan. The contributions and benefits are based on the general regulations and the ANWR pension plan.

The Substitute Occupational Benefit Institution must receive your completed and signed registration, along with the required documents, no later than three months following the end of your employment relationship.

You can conclude voluntary insurance with us for occupational pension provision in the SE plan for the amount of statutory benefits.

You may also do the following:

- Insure benefits for the income components between the BVG maximum salary and the UVG maximum salary

- Include the risk of accident in your insurance in case of disability and death

In this case, please enclose the following documents:

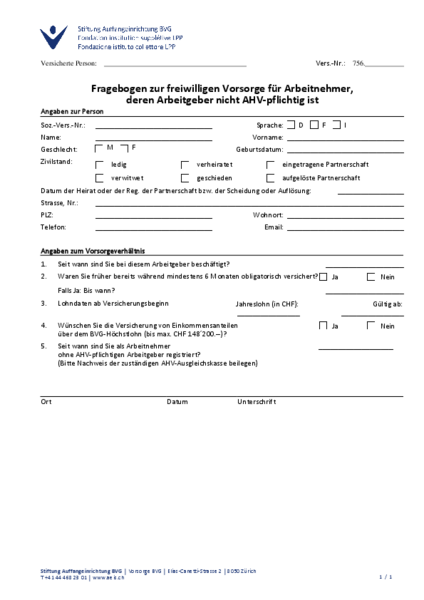

- Completed and signed questionnaire for voluntary insurance (ANobAG questionnaire)

- Completed and signed notification of joining

- Proof from the AHV compensation fund that you are registered as an employee of an employer that is not subject to contributions

- Completed and signed registration for individuals

- Completed and signed VP health questionnaire

Documents

-

Factsheet W20 plans

-

Questions and answers W20 plans

-

Anmeldung Einzelperson

-

Arbeitsunfähigkeitsmeldung

-

Eintrittsmeldung

-

Fragebogen zur freiwilligen Versicherung MA

-

Fragebogen AnobAg

-

Fragebogen SE

-

Fragebogen WG20

-

Fragebogen WO20

-

Fragebogen WR

-

Fragebogen ANW

-

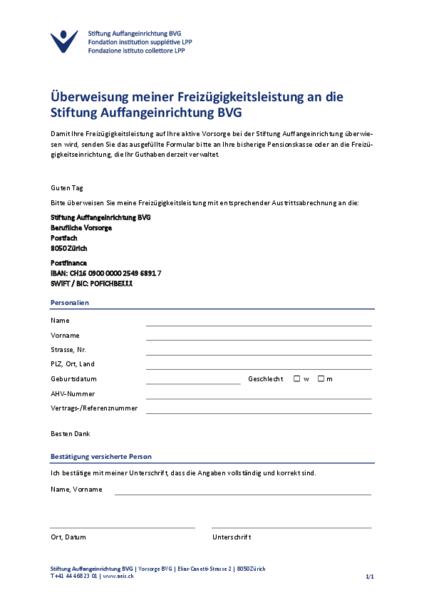

Überweisung meiner Freizügigkeitsleistung an die Stiftung Auffangeinrichtung BVG

-

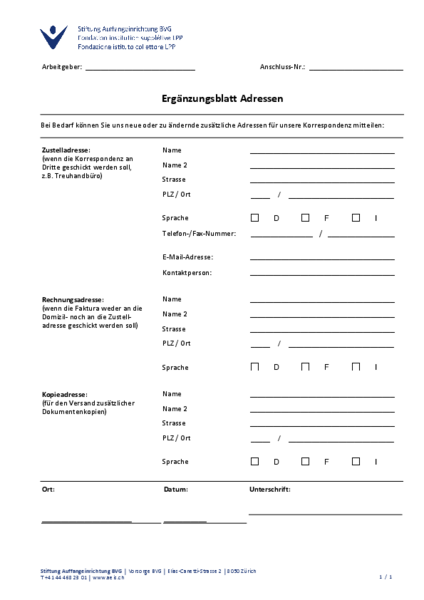

Zusatzblatt Adressen

Links

Kontakt

Contact

Stiftung Auffangeinrichtung BVG

Berufliche Vorsorge

8050 Zürich

+41 41 799 75 75

Call service

We will be happy to call you at the desired time to clarify your request - conveniently and free of charge.

Choose date