Every salary counts!

Provide your employees with more than just minimum insurance coverage. Select the AN Plus pension plan. This will enable your employees to have higher retirement savings capital and extended protection in the event of disability and death.

In brief

-

Low entry threshold: Tiny salaries can be insured from CHF 2'500, not only from the statutory entry threshold of CHF 22'680.

-

No coordination deduction: AN Plus covers the entire salary, up to the upper limit of CHF 90'720.

-

More of the salary is insured: Of the maximum insured salary of CHF 90'720, CHF 64'260 is covered by mandatory insurance and CHF 26'460 is covered by super-mandatory insurance.

-

Bundle salaries of employees with multiple jobs: For every part-time job below the entry threshold, 100% of the salary can be insured.

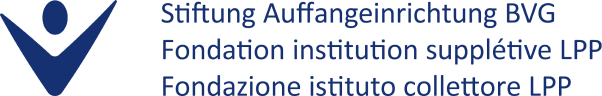

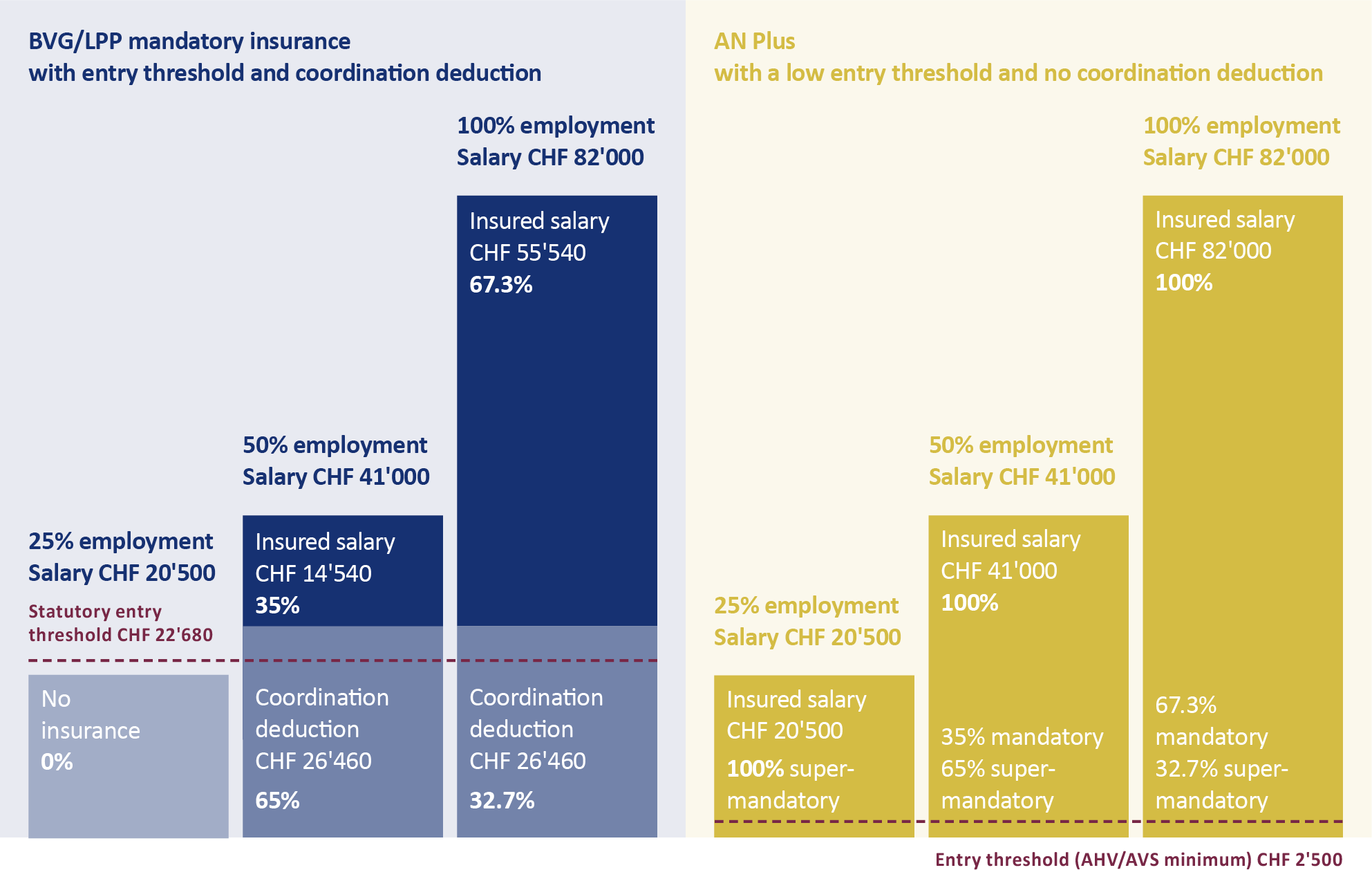

Comparison of BVG/LPP mandatory insurance and AN plus benefits

BVG/LPP mandatory insurance: Those who earn less not only have a lower salary, but also a propor-tionately lower insured income.

AN Plus: Employees are insured with AN Plus at 100% of their salary (up to the maximum upper limit). More insured income means higher retirement savings and better benefits in the event of disability or death.

BVG/LPP mandatory insurance: Those who earn less not only have a lower salary, but also a propor-tionately lower insured income.

AN Plus: Employees are insured with AN Plus at 100% of their salary (up to the maximum upper limit). More insured income means higher retirement savings and better benefits in the event of disability or death

Why is AN Plus the better solution?

Improve part-time and full-time insurance coverage

Insure more of the salary: a larger part of the income counts towards the pension benefits.

Low salaries – now insurable

Insure small part-time salaries that are not covered by BVG/LPP mandatory insurance.

Higher insurance for good salaries

No coordination deduction increases your insured salary.

Multiple jobs? No problem!

Simply include multiple workloads with different employers.

Request a non-binding consultation now

Contact

Stiftung Auffangeinrichtung BVG

Berufliche Vorsorge

8050 Zürich

+41 41 799 75 75

Call service

We will be happy to call you at the desired time to clarify your request - conveniently and free of charge.

Choose dateDocuments

This section of our website is not or not completly available in your preferred language.

Alternatively, you can visit the page in one of the languages available: