Pension benefits in line with mandatory insurance

Employers are legally obliged to insure their employees under the occupational pension scheme. With our AN basic pension plan, you can fulfil this obligation simply and reliably – within the framework of legal requirements.

In brief

-

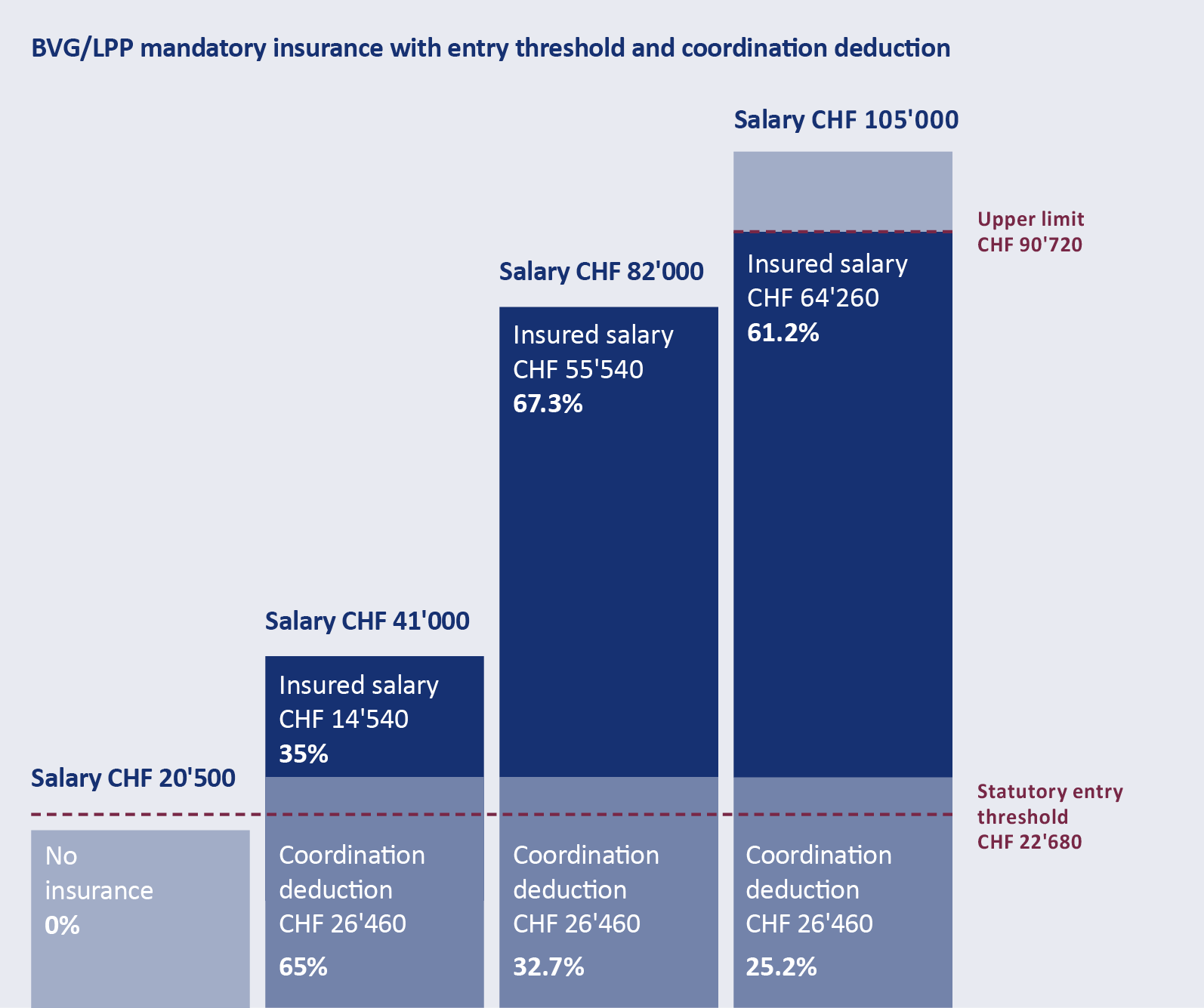

Employees with an annual salary above the statutory entry threshold of CHF 22'680 are insured.

-

The insured salary is the annual salary minus the coordination deduction of CHF 26'460.

-

The salary is insured up to the upper limit of CHF 90'720.

-

BVG/LPP mandatory insurance is basic insurance in the event of retirement, disability and death.

BVG/LPP mandatory insurance benefits

BVG/LPP mandatory insurance: Salaries below the entry threshold cannot be insured. The fixed coordination amount is deducted from the annual salary. The insured salary is the annual salary minus the coordination deduction. Salaries up to the upper limit are insured under BVG/LPP mandatory insurance.

The AN plan covers those salary portions that are covered by the law in the second pillar. It ensures that your employees have minimum statutory protection in the event of retirement, disability or death.

Further information: Federal Social Insurance Office (BSV/OFAP)

The AN plan is for employers who want to offer their employees solid basic insurance.

As soon as the annual salary of your employees exceeds the statutory entry threshold (CHF 22'680), the insured salary is calculated: Payroll minus coordination deduction (CHF 26'460).

The salary is insured up to the upper limit of CHF 90'720. With deduction of the coordination deduction, the maximum insured salary amounts to CHF 64'260.

Savings and risk contributions financed jointly by employers and employees are based on this insured salary. They determine the subsequent retirement savings capital as well as the benefits in the event of disability and death of the insured person.

AN plan

Have you insured your staff subject to BVG/LPP contributions with a pension fund? If not: find out more now and register for the AN plan.

Reinstatement

Ensure that your employees subject to BVG/LPP contributions are insured without any gaps in coverage. – Did you rejoin a pension fund in good time after the termination of your pension fund agreement? If not, do so now. Otherwise, the Substitute Occupational Benefit Institution must make you a member of the AN plan and you will have no choice where this is concerned.

Request a non-binding consultation now

Contact

Stiftung Auffangeinrichtung BVG

Berufliche Vorsorge

8050 Zürich

+41 41 799 75 75

Call service

We will be happy to call you at the desired time to clarify your request - conveniently and free of charge.

Choose dateDocuments

This section of our website is not or not completly available in your preferred language.

Alternatively, you can visit the page in one of the languages available: