Cash payout due to self-employment

Are you self-employed as your main source of income in Switzerland and wish to withdraw your capital?

When is a cash payout of my vested benefits prior to retirement possible?

This video explains when it is possible to receive a cash payout of your vested benefits before you retire.

Subtitles can be activated by clicking on the CC icon at the bottom right of the video.

Next steps

We need a number of documents from you in order to make a cash payout due to your self-employment. The documents we need depend on your account balance at the time of payout. Please select the case that applies to you:

Please send us your details via the online form or send us the following documents:

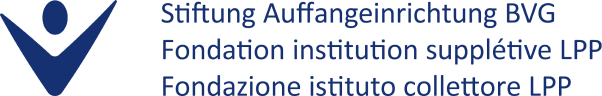

- Signed and completed form Cash payout due to self-employment < CHF 20’000.00

- Copy of your OASI (AHV/AVS) card

- Copy of your identity card or passport

- If you are married or in a registered partnership: copy of your spouse’s / partner’s identity card or passport

- If you are married or in a registered partnership: copy of your marriage certificate / partnership certificate

- If you are divorced or your partnership has been dissolved: copy of the complete, legal divorce decree / decree dissolving your partnership

- Current confirmation from the OASI (AHV/AVS) compensation fund that you are self-employed (not more than three months old)

Please send us your details via the online form or send us the following documents:

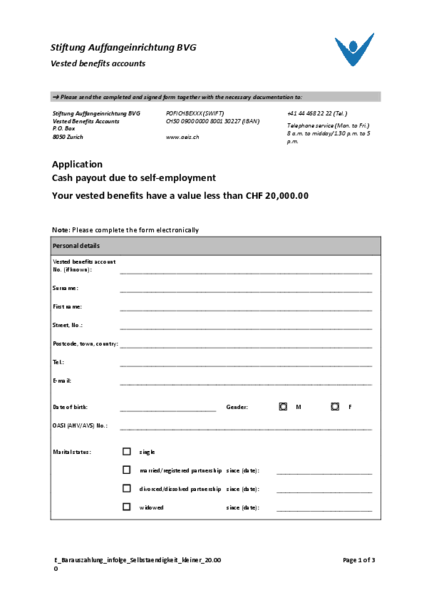

- Completed form Cash payout due to self-employment > CHF 20’000.00 with certification of signature(s) (notary, municipality)

- Copy of your OASI (AHV/AVS) card

- If you are married or in a registered partnership: copy of your marriage certificate / partnership certificate

- If you are divorced or your partnership has been dissolved: copy of the complete, legal divorce decree / decree dissolving your partnership and current certificate of civil status (not more than three months old)

- If you are single or widowed: current certificate of civil status (not more than three months old)

- Current confirmation from the OASI (AHV/AVS) compensation fund that you are self-employed (not more than three months old)

We may need additional information and documents. We will contact you if this is the case.

Important information

- Anyone who founds a GmbH (Limited liability company) or an AG (Public limited company) is not self-employed, but employed. In these cases, the retirement assets cannot be drawn.

- If you have emigrated and are working as a self-employed person abroad, you may meet the conditions for payment of your balance on moving abroad.

- We are obliged to report payments over CHF 5000.00 to the tax authorities under the regulations.

- If you have your residence abroad, source tax will be deducted on payments of CHF 1000.00 or more.

Online Services

Links

Account statement

You are sent an account statement automatically at the beginning of the year. However you would now like to order a statement mid-year.

Cash payout due to emigration

You are leaving Switzerland permanently and would like to withdraw some or all of your capital.

Contact

Contact

Stiftung Auffangeinrichtung BVG

Vested benefits accounts

8050 Zurich

+41 41 799 75 75

Call service

We will be happy to call you at the desired time to clarify your request - conveniently and free of charge.

Choose date