Cash payout due to invalidity

You receive a full pension from OASI (AHV/AVS)/invalidity insurance (from 70% invalidity) and would like to withdraw your capital.

Next steps

You receive a full pension from OASI (AHV/AVS)/invalidity insurance (from 70% invalidity) and would like to withdraw your capital.

Please send us your details via the online form or send us the following documents:

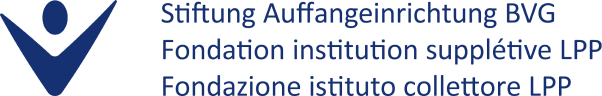

- Signed and completed form Cash payout due to invalidity < CHF 20’000.00

- Copy of your OASI (AHV/AVS) card

- Copy of your identity card or passport

- If you are married or in a registered partnership: copy of your spouse’s / partner’s identity card or passport

- If you are married or in a registered partnership: copy of your marriage certificate / partnership certificate

- If you are divorced or your partnership has been dissolved: copy of the complete, legal divorce decree / decree dissolving your partnership

- Copy of the current invalidity insurance decision (Please note that we only accept rulings issued by a Swiss DI office)

Please send us your details via the online form or send us the following documents:

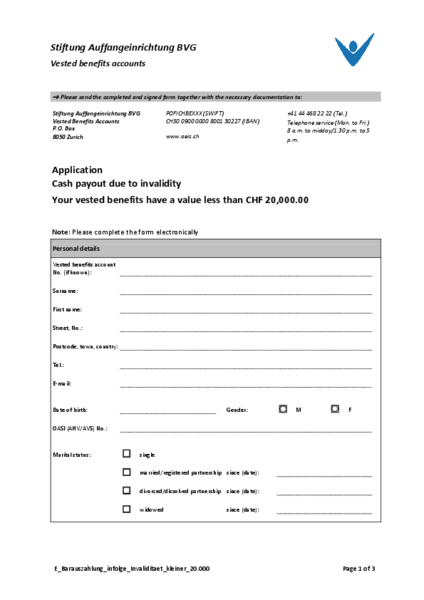

- Completed form Cash payout due to invalidity > CHF 20’000.00 with certification of signature(s) (notary, municipality)

- Copy of your OASI (AHV/AVS) card

- If you are married or in a registered partnership: copy of your marriage certificate / partnership certificate

- If you are divorced or your partnership has been dissolved: copy of the complete, legal divorce decree / decree dissolving your partnership and current certificate of civil status (not more than three months old)

- If you are single or widowed: current certificate of civil status (not more than three months old)

- Copy of the current invalidity insurance decision (Please note that we only accept rulings issued by a Swiss DI office)

We may need additional information and documents. We will contact you if this is the case.

Important information

- Money from vested benefits accounts cannot be paid out in the form of a pension.

- Please clarify with your former benefits scheme whether you are entitled to a pension from there.

- We are obliged to report payments over CHF 5'000.00 to the tax authorities under the regulations.

- If you have your residence abroad, source tax will be deducted on payments of CHF 1'000.00 or more.

Online Services

Links

Account statement

You are sent an account statement automatically at the beginning of the year. However you would now like to order a statement mid-year.

Contact

Contact

Stiftung Auffangeinrichtung BVG

Vested benefits accounts

8050 Zurich

+41 41 799 75 75

Call service

We will be happy to call you at the desired time to clarify your request - conveniently and free of charge.

Choose date