Promotion of home ownership (WEF)

You would like to withdraw or pledge your vested benefits in order to purchase owner-occupied residential property (minimum amount CHF 20'000.00).

Next steps

We need a number of documents from you in order to make a payout for promotion of home ownership. The documents we need depend on the use of your capital. Please select the case that applies to you:

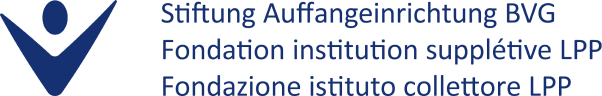

Please send us your details via the online form or send us the following documents:

- Signed and completed form Promotion of home ownership – advance withdrawal

- Copy of your OASI (AHV/AVS) card

The advance withdrawal is permitted for:

- the repayment of a mortgage on owner-occupied residential property

- the purchase of an owner-occupied house or apartment

- the construction of owner-occupied residential property

- the acquisition of share certificates for my owner-occupied residential property

- the renovation of my owner-occupied residential property

Please note:

- The costs for an early withdrawal are CHF 400.00. This amount will be charged to your vesting account.

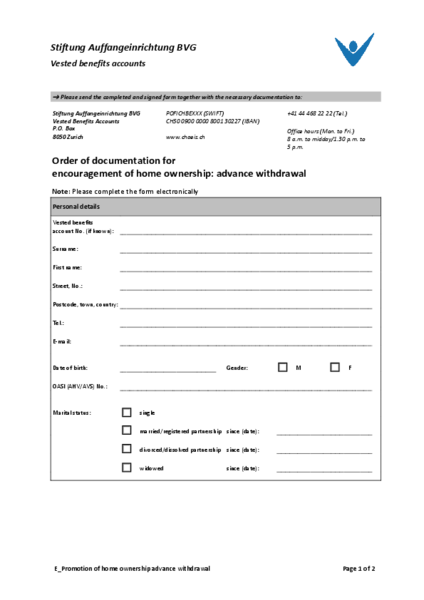

Please send us your details via the online form or send us the following documents:

- Signed and completed form Promotion of home ownership – pledge

- Copy of your OASI (AHV/AHS) card

Please note:

- The costs of arranging a pledge are CHF 200. This amount will be charged to your vesting account.

Important information

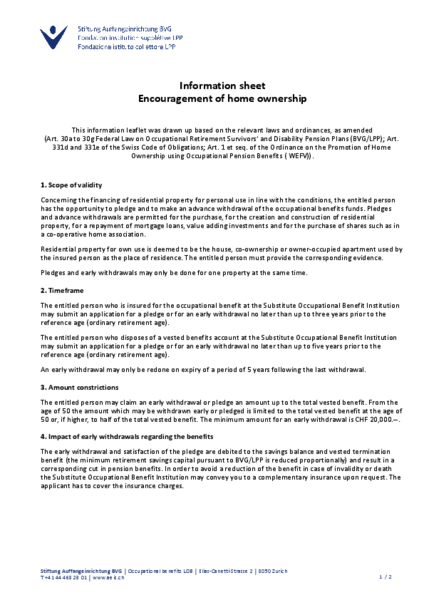

Please note the following before applying to invoke promotion of home ownership:

- If you are currently insured with a benefits scheme via your employer, you must first transfer your vested benefits managed by us to this benefits scheme and apply to this scheme for advance withdrawal.

- The advance withdrawal or pledge may be used for the purchase/mortgage repayment or construction of owner-occupied single-family dwellings or condominiums but not for the purchase of building land. The payout is made only to a mortgage/building account or to the vendor’s account.

- The minimum amount for an advance withdrawal or pledge is CHF 20'000.00. There is no minimum amount for the acquisition of shares.

- If you have reached the age of 50, you may withdraw your vested benefits as at age 50 or half of your current vested benefits as promotion of home ownership.

Please note in all cases:

- We are obliged to report payments for the promotion of home ownership to the tax authorities under the regulations.

- If you have your residence abroad, source tax will be deducted.

Online Services

Links

Transfer to new pension fund

ou are an employee and are insured with a benefits scheme. You therefore need to transfer your vested benefits to this benefits scheme.

Contact

Contact

Stiftung Auffangeinrichtung BVG

Vested benefits accounts

8050 Zurich

+41 41 799 75 75

Account details

Postal account: 80-13022-7

BIC / SWIFT: POFICHBEXXX

IBAN: CH50 0900 0000 8001 3022 7

Call service

We will be happy to call you at the desired time to clarify your request - conveniently and free of charge.

Choose date