Cash payout of accounts for small amounts

Your vested benefits have less value than your personal annual contribution to your former benefits scheme?

You would therefore like to withdraw your capital.

When is a cash payout of my vested benefits prior to retirement possible?

This video explains when it is possible to receive a cash payout of your vested benefits before you retire.

Subtitles can be activated by clicking on the CC icon at the bottom right of the video.

Next steps

In order for us to be able to make the cash payment for your vested benefits, you need to send us your details via the online form or send us the following documents:

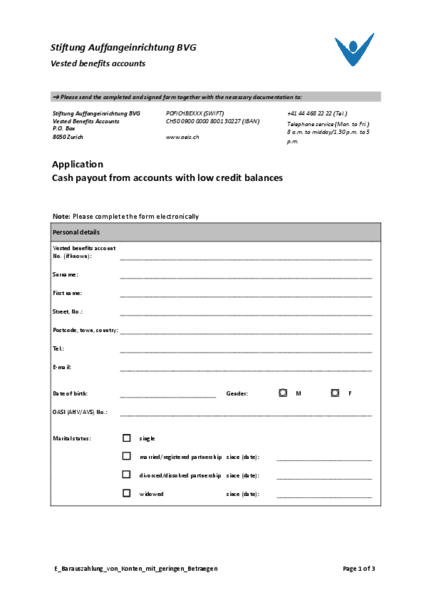

- Completed form Cash payout from accounts with low credit balances

- Copy of your OASI (AHV/AVS) card

- Copy of your identity card or passport

- If you are married or in a registered partnership: copy of your spouse’s / partner’s identity card or passport and copy of your marriage certificate / partnership certificate

- If you are divorced or your partnership has been dissolved: copy of the complete, legal divorce decree / decree dissolving your partnership

- Confirmation from the benefits scheme that transferred the vested benefits to us that your vested benefits have a value less than your (former) personal annual contribution

We may need additional information and documents. We will contact you if this is the case.

Important information

- We are obliged to report payments over CHF 5'000.00 to the tax authorities under the regulations.

- If you have your residence abroad, source tax will be deducted on payments of CHF 1'000.00 or more.

Online Services

Kontakt

Contact

Stiftung Auffangeinrichtung BVG

Vested benefits accounts

8050 Zurich

+41 41 799 75 75

Call service

We will be happy to call you at the desired time to clarify your request - conveniently and free of charge.

Choose date