More salary insured, more security

Do you employ people on a part-time or full-time basis with a salary above the statutory entry threshold? – One example:

«Thanks to AN Plus, my entire salary is now insured. This shows that our management is looking after the team and taking our concerns seriously.»

Problem

By law, a fixed amount of CHF 26'460 is deducted from the annual salary (coordination deduction) – regardless of the level of income. This deduction is particularly significant for people with lower or part-time salaries above the entry threshold and reduces the insured salary particularly strongly. However, even those who work full-time cannot have their salary insured in the mandatory occupational pension scheme without a coordination deduction and end up saving less for their retirement.

Solution

From an income of more than CHF 2'500, the entire salary is insured in AN Plus, up to the upper limit of CHF 90'720 – without any coordination deduction. The portion that is lost under BVG/LPP mandatory insurance as a result of the coordination deduction is covered by super-mandatory insurance in the AN Plus plan.

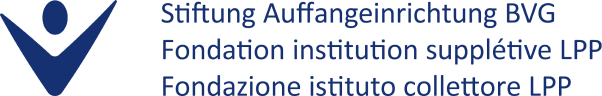

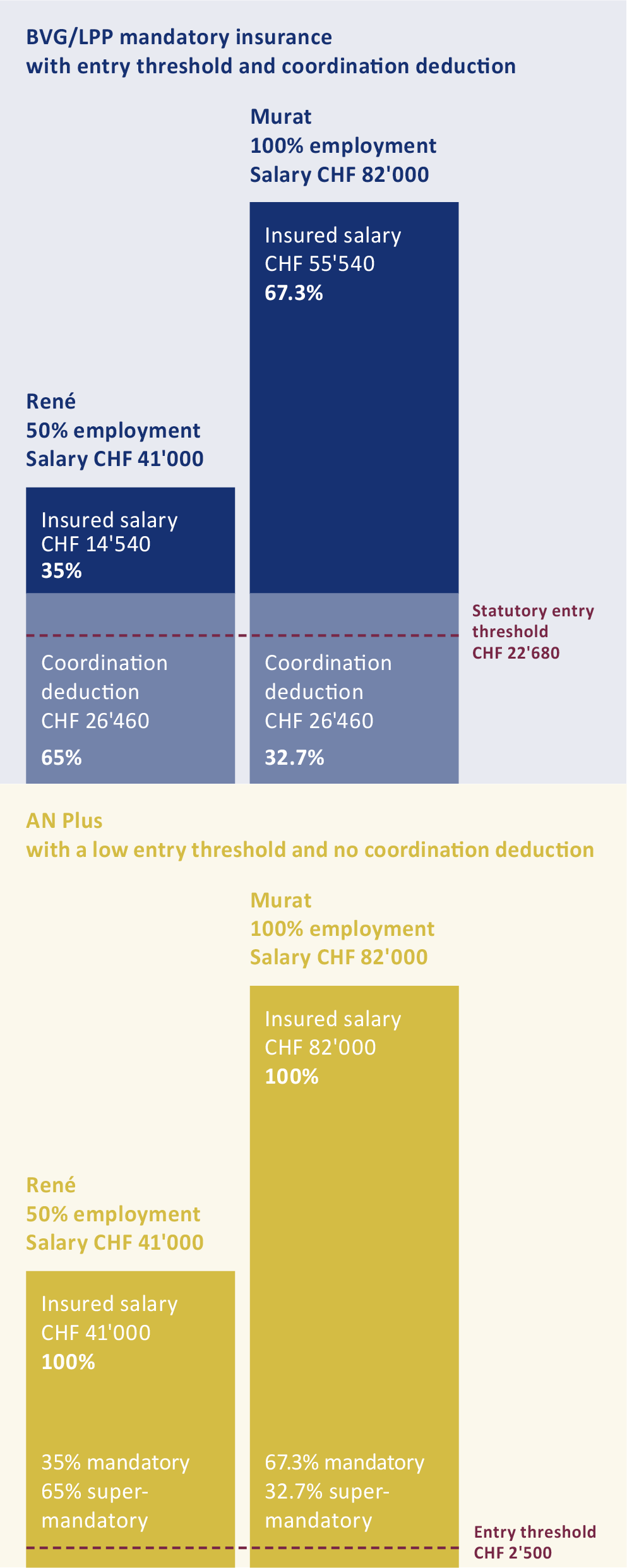

Example: Part-time and full-time work with salary above the statutory entry threshold

René and Murat both work under the same terms of employment at the same garage. René works 50% and Murat works full-time. The Executive Board has opted for the AN Plus plan. This change has positive effects for both employees.

BVG/LPP mandatory insurance: Thanks to the fixed coordination deduction, René has a much lower insured salary in percentage terms than Murat. But even for Murat, part of the salary is not insured.

AN Plus: Under AN Plus, the insured salary for René and Murat increases to 100%, and the portion that would otherwise be omitted due to the coordination deduction is covered on a super-mandatory basis. This results in more insured income, higher retirement capital and better benefits for both in the event of disability or death.

BVG/LPP mandatory insurance: Thanks to the fixed coordination deduction, René has a much lower insured salary in percentage terms than Murat. But even for Murat, part of the salary is not insured.

AN Plus: Under AN Plus, the insured salary for René and Murat increases to 100%, and the portion that would otherwise be omitted due to the coordination deduction is covered on a super-mandatory basis. This results in more insured income, higher retirement capital and better benefits for both in the event of disability or death.