More salary insured, more security

Do you have employees whose salary exceeds the upper limit? Or is your own salary higher than the upper limit? – One example:

«AN Plus dispenses with the coordination deduction: that's great! This means that my employees and I can now save more for retirement and are protected at the same time.»

Problem

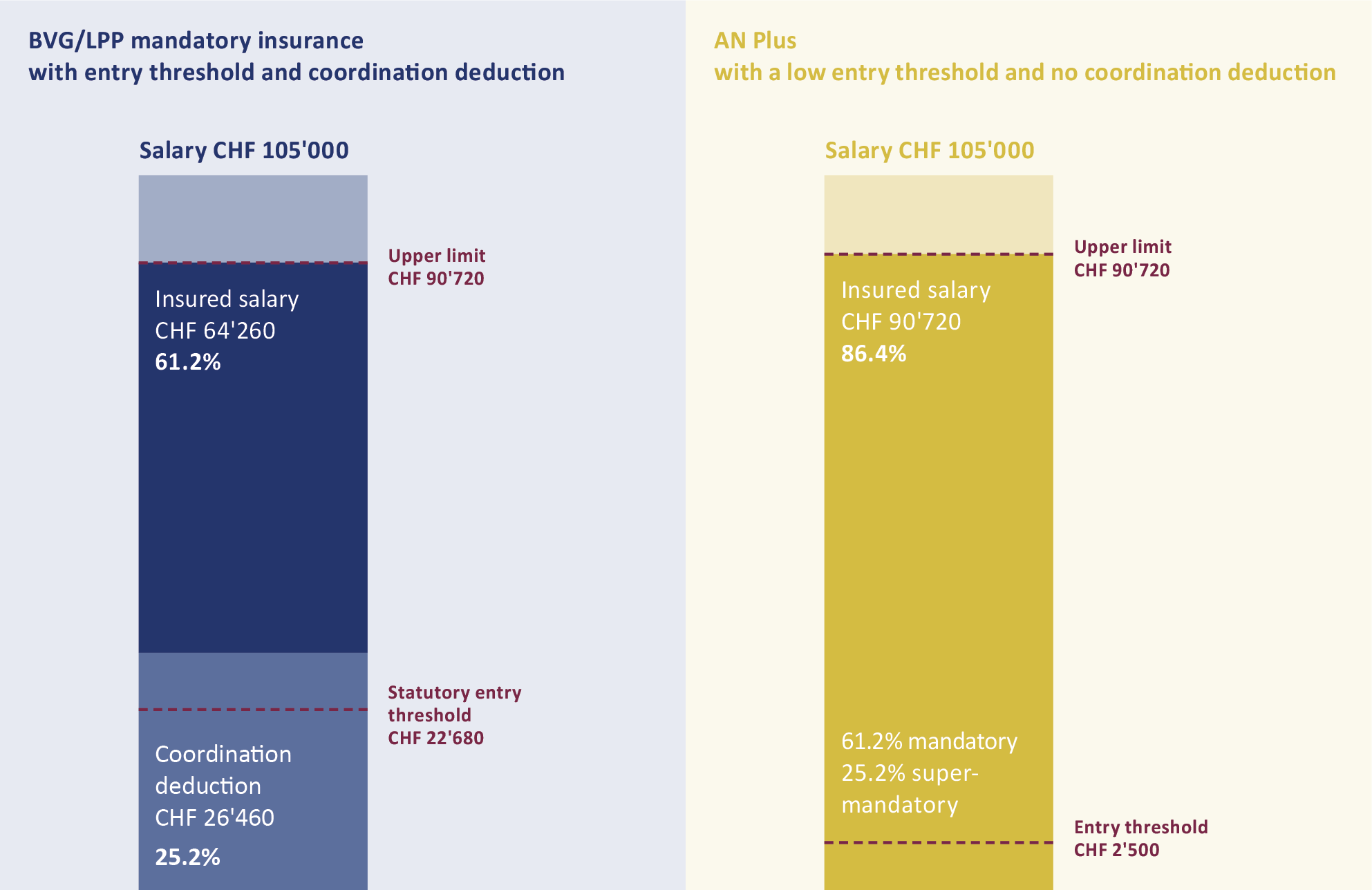

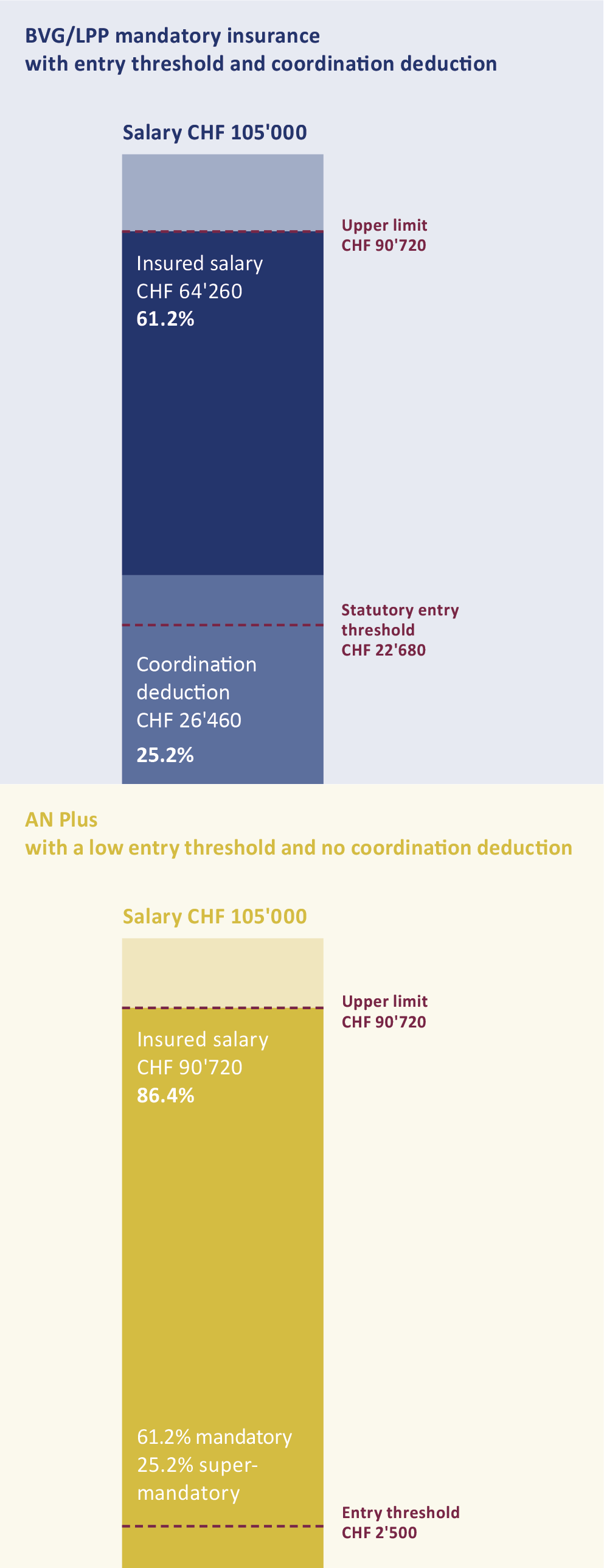

No matter how much someone earns, the maximum insured salary according to BVG/LPP mandatory insurance is CHF 64'260 per year (upper limit of CHF 90'720 minus coordination deduction of CHF 26'460).

Solution

Under AN Plus, no coordination deduction is applied. The maximum insured salary is CHF 90'720, of which CHF 64'260 is mandatory and CHF 26'460 is super-mandatory. This also increases the amount of voluntary contributions to the pension fund, which can save tax.

Example: Salary above upper limit

Julia is the owner and manager of a florist's shop with four part-time employees. She now voluntarily insures her employees and also herself under AN Plus. But how does Julia herself benefit from AN Plus with a salary of CHF 105'000, which is above the upper limit?

BVG/LPP mandatory insurance: Julia reaches the maximum insured salary of CHF 64'260 under BVG/LPP mandatory insurance (upper limit; minus coordination deduction).

AN Plus: With AN Plus, Julia benefits from the absence of a coordination deduction: her insured salary increases to the upper limit of CHF 90'720 compared to BVG/LPP mandatory insurance. AN Plus leads to greater security and better benefits for the employees and also for herself.

BVG/LPP mandatory insurance: Julia reaches the maximum insured salary of CHF 64'260 under BVG/LPP mandatory insurance (upper limit; minus coordination deduction).

AN Plus: With AN Plus, Julia benefits from the absence of a coordination deduction: her insured salary increases to the upper limit of CHF 90'720 compared to BVG/LPP mandatory insurance. AN Plus leads to greater security and better benefits for the employees and also for herself.