Protection – even for low salaries

Do you employ part-time workers with salaries below the statutory entry threshold?

«Now I can insure my employee with AN Plus and invest even more in trust and motivation.»

Problem

Many part-time employees earn an annual salary below the statutory entry threshold of CHF 22'680. As a result, they have hardly any retirement provision and no insurance in the event of disability and death under the 2nd Pillar.

Solution

With AN Plus, income from as little as CHF 2'500 can be insured, including against disability and death. This also makes it possible to make savings contributions for retirement when salaries are low.

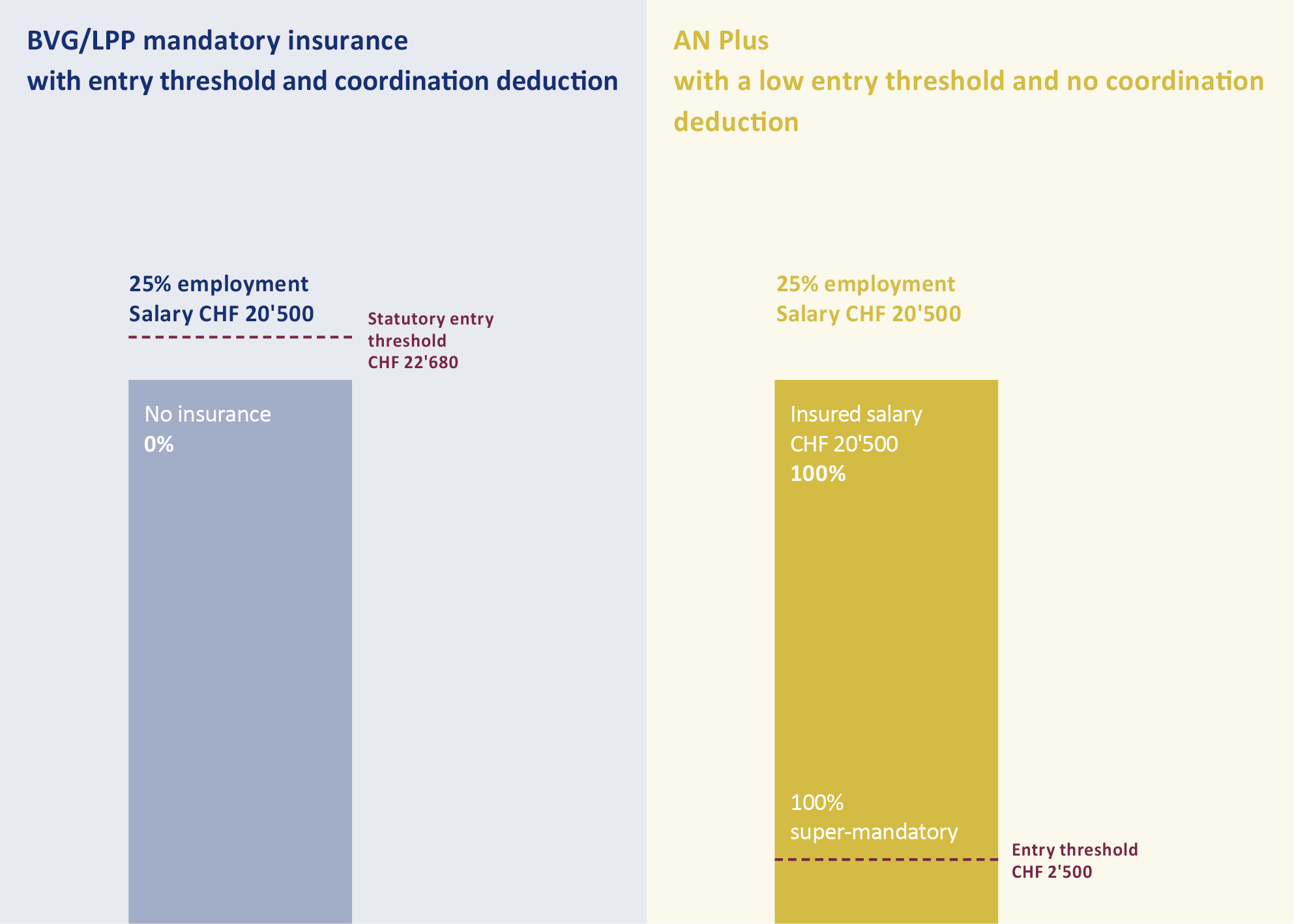

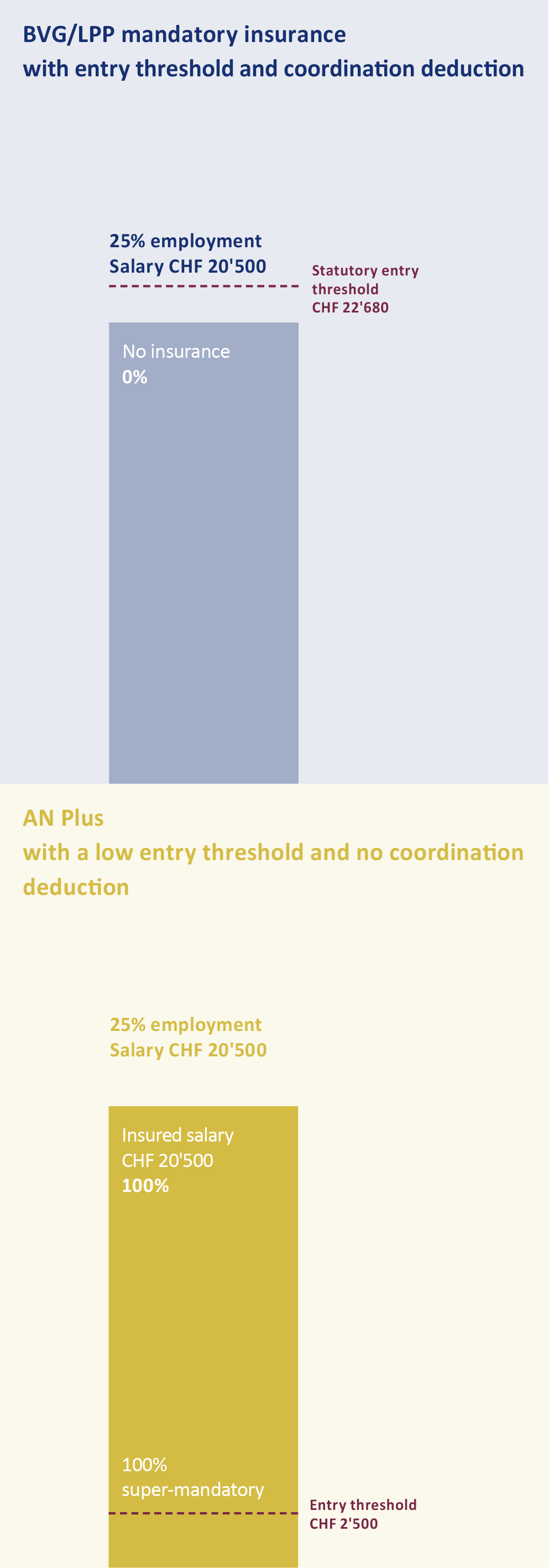

Example: Part-time work with salary below the statutory entry threshold

Sara works part-time in Daniel’s household. With a workload of 25%, she earns CHF 20'500 a year. In order to enable employer Daniel to offer his employee Sara attractive employment conditions

BVG/LPP mandatory insurance: As Sara’s salary is below the statutory entry threshold, she is not covered by BVG/LPP mandatory insurance.

AN Plus: Thanks to AN Plus, Sara’s entire salary is insured. In this way, she sets aside retirement savings and is protected in the event of disability and death.

BVG/LPP mandatory insurance: As Sara’s salary is below the statutory entry threshold, she is not covered by BVG/LPP mandatory insurance.

AN Plus: Thanks to AN Plus, Sara’s entire salary is insured. In this way, she sets aside retirement savings and is protected in the event of disability and death.